By Dr. John E. Charalambakis.

Close to twenty years ago, the Eurocrats decided to defy the laws of gravity in economics, and they started designing a common currency without a fiscal union. Their thinking was straight-forward: “If we suspend the law of gravity, the Euro will be sustained (like if gravity is suspended and you throw a stone up in the air, the stone will keep going up)”. Welcome to the logic of Eurocrats!

The game became even more interesting since the cheating on the “rules” (a.k.a. deviation from the fiscal constraints) was allowed from the very beginning for the big players like Germany and France. Then, the big players in order to create momentum for their dysfunctional design (Euro), allowed creative accounting so that countries that should have never been allowed to join the Eurozone (such as Greece and others in the South), were welcomed. No wonder that we may be destined for a head-to-head coalition between a small Chevy and an 18-wheeler truck. The bottom line is that disruptions and market dislocations will happen, and the illusions for a European firewall will be exposed as I wrote about three weeks ago (http://blacksummitfg.com/2835). After reviewing some basic facts I will discuss a couple of out-of-the-box possible solutions.

Let us review some basic facts about the Greek situation:

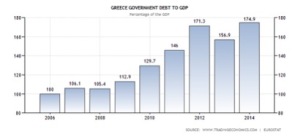

- The Greek debt is unsustainable. At almost 175% of GDP (after the 2012 private sector haircut!), the Greek state is condemned to a perpetual recession where the debt overhang feeds uncertainty, disinvestment, speculation, unemployment, and misery. How in the world could someone say that Greece is better off today with 175% debt-to-GDP ratio than in 2009 when the ratio was less than 115%, as the graph below shows?

- If too much unproductive debt (that fed vested interests, the clientele base of the governments, and the wasteful and inefficient public sector) was one of the main causes of the Greek tragedy, more debt (pushed by the Eurocrats) is certainly not the remedy! The addiction at some point needs to stop, catharsis to take place, so that dormant capital to be awaken.

- Why don’t we ask a basic question: Who are the ones who benefited from the Greek bailouts which in turn became the culprits to over blow the debt situation and who now have condemned Greece to a state of depression? How much of the more than $220 billion of the bailout packages were invested in Greece? How much of that huge amount was used for wealth creation? How much for infrastructure? Ho much for human capital? How much even for social programs? The answer is less than 8%. So, the funds were used to bail out mainly European banks, i.e. European states and the ECB bailed out investors, rather than allowing the free market to operate freely and do its job of cleansing bubbles, and excesses. This kind of paternalistic capitalism distorts reality, creates illusions and asymmetries, while creating debt pyramids and the invention of financial products that resemble more and more weapons of mass deception.

- Since 2010 I have been arguing from these pages that you cannot add by subtracting. The solution is not more and more austerity along with higher and higher taxes. Unless you allow room to grow the pie, each one’s slice will get smaller and smaller.

- During the 2007-’09 crisis, most EU banks (as well as several “giants” in the US) were simply bankrupt. If it were not for the US Fed to bail them out with trillions of dollars and almost open-ended lines of credit and swaps, very few (if any) EU banks would be standing today. From these pages again, I have shown the trillions of dollars used to save those banks, as revealed by the Fed’s audit.

- Direct line of credit against energy exploration rights.

- Arrange for a US bond repo program with the U.S. Treasury. Use the bonds as collateral (implying also rehypothecating them as much as possible) and generate lines of credit.

- Cut a deal with one of the Fed’s primary dealers where the latter borrow the bonds through the reverse repo program – on behalf of the Greek gov’t – rehypothecate them through their circles and generate the needed lines of credit.

I was thinking of a series of dreams

Where nothing comes up to the top Everything stays down where it’s wounded

And comes to a permanent stop

Wasn’t thinking of anything specific Like in a dream, when someone wakes up and screams

Nothing too very scientific

Just thinking of a series of dreams

Thinking of a series of dreams

Where the time and the tempo fly And there’s no exit in any direction

Except the one that you can’t see with your eyes

Wasn’t making any great connection

Wasn’t falling for any intricate scheme

Nothing that would pass inspection

Just thinking of a series of dreams

Dreams where the umbrella is folded

Into the path you are hurled

And the cards are no good that you’re holding

Unless they’re from another world

In one, numbers were burning

In another, I witnessed a crime

In one, I was running, and in another All I seemed to be doing was climb

Wasn’t looking for any special assistance

Not going to any great extremes

I’d already gone the distance

Just thinking of a series of dreams

Δεν υπάρχουν σχόλια:

Δημοσίευση σχολίου

Tο μπλοκ μας δημοσιεύει κάθε σχόλιο. Θεωρούμε ότι ο καθένας έχει το δικαίωμα να εκφράζει ελεύθερα τις απόψεις του. Ωστόσο, αυτό δεν σημαίνει ότι υιοθετούμε τις απόψεις αυτές, και διατηρούμε το δικαίωμα να μην δημοσιεύουμε συκοφαντικά ή υβριστικά σχόλια όπου τα εντοπίζουμε.

Όσοι επιθυμούν να παίρνουν τις αναρτήσεις από το μπλογκ μπορούν να το κάνουν ελεύθερα με την παράκληση όπως σαν πηγή ενημέρωσης να αναφέρουν το ιστολόγιο μας.

Σημείωση: Μόνο ένα μέλος αυτού του ιστολογίου μπορεί να αναρτήσει σχόλιο.